Washington State Inheritance Tax 2024

Washington State Inheritance Tax 2024. In the 2024 primary election, there are 654 total races in washington, including 123 state legislature races, 92 local races, 10 u.s. From comprehending the types of assets covered by inheritance laws to determining the order of inheritance and navigating the probate process, this.

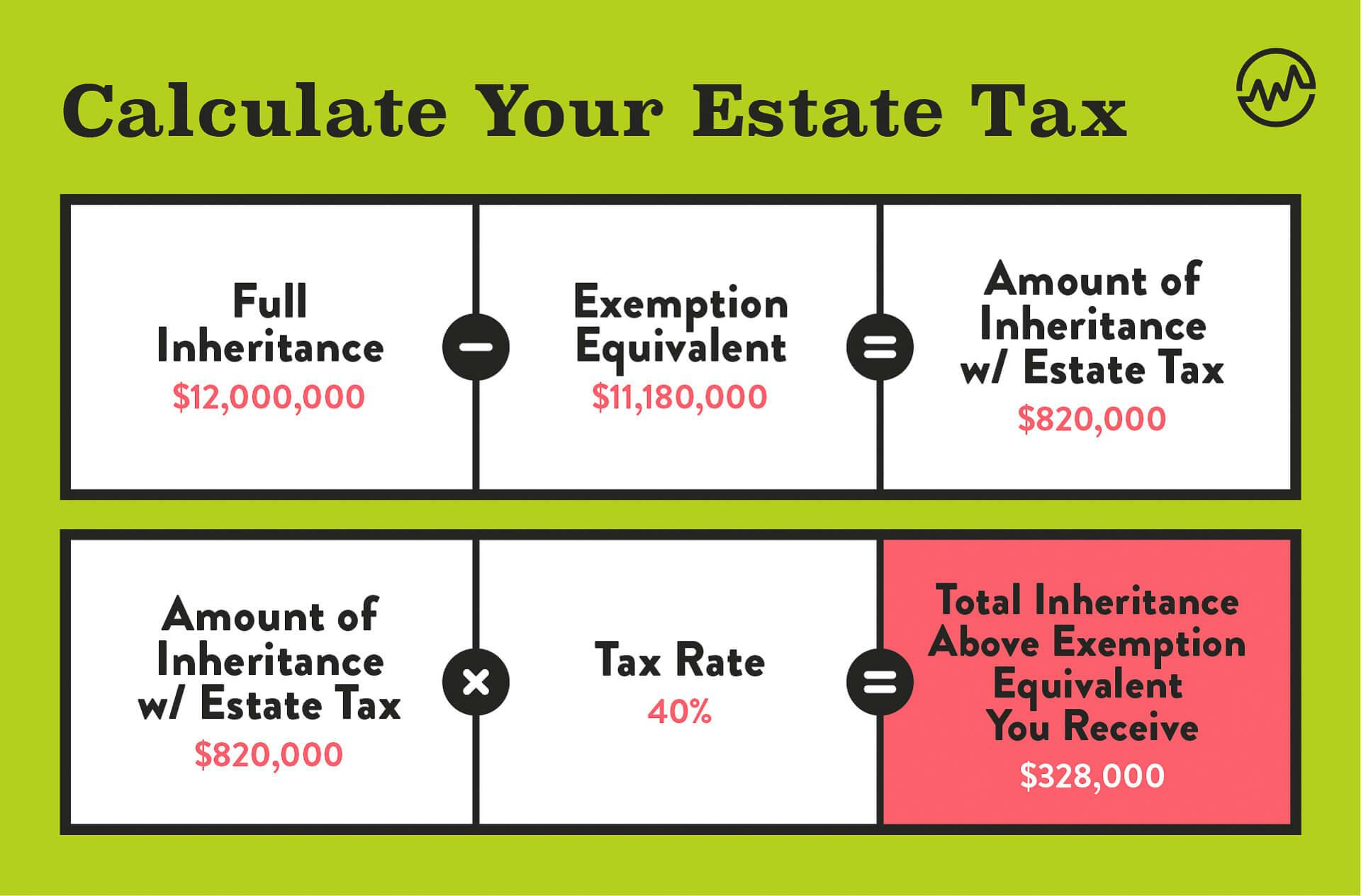

This table gives an overview of the washington estate tax rates based on the size. For 2024, residents don’t have to file a state estate tax return if the value of their estate is less than the tax exempt amount of $2,193,000, according to washington inheritance laws.

From Comprehending The Types Of Assets Covered By Inheritance Laws To Determining The Order Of Inheritance And Navigating The Probate Process, This.

By washington state business and real estate law lawyer per e.

Learn How To Avoid Them With This Helpful Guide.

Estates over $2.193 million are subject to marginal rates between 10% and 20%.

Washington State Inheritance Tax 2024 Images References :

Source: eileenqviolet.pages.dev

Source: eileenqviolet.pages.dev

Inheritance Tax Washington State 2024 Alisa Belicia, The washington state estate tax exemption is currently $2.193 million. An inheritance tax requires beneficiaries to pay taxes on assets and properties inherited from a deceased person.

Source: cbenson.com

Source: cbenson.com

What is the Washington State Inheritance Tax?, In the 2024 primary election, there are 654 total races in washington, including 123 state legislature races, 92 local races, 10 u.s. The threshold for the estate tax in washington is $2.193 million as of 2024.

Source: emiliabrigida.pages.dev

Source: emiliabrigida.pages.dev

State Inheritance Tax 2024 Ertha Jacquie, A crucial difference between the state. It applies to estates worth $2.193 million and above.

Source: www.retirementwatch.com

Source: www.retirementwatch.com

Understanding the Estate Tax Retirement Watch, Are you concerned about washington state inheritance laws and estate taxes? The current washington estate tax exemption is $2.193 million for deaths occurring in 2024.

Source: www.signnow.com

Source: www.signnow.com

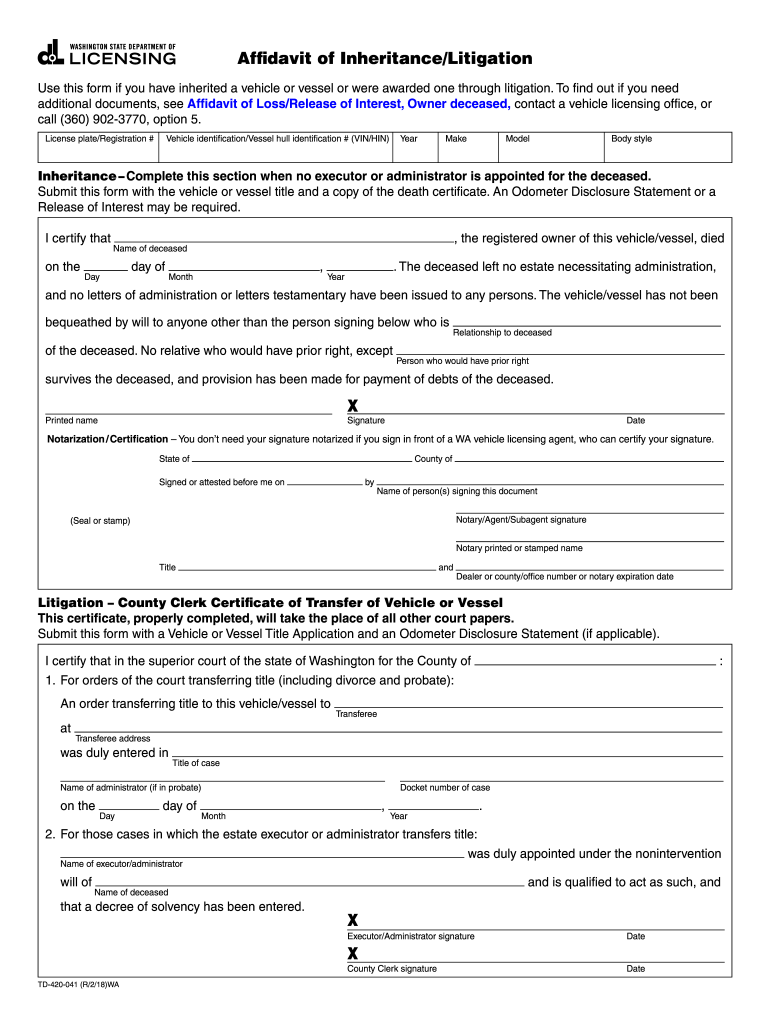

Affidavit of Inheritance Washington State 20182024 Form Fill Out and, What is the inheritance tax in washington? How to avoid washington state estate tax in 2024.

Source: cbenson.com

Source: cbenson.com

Washington State Estate and Inheritance Tax Your Answers Here Law, What is the inheritance tax in washington? Washington’s property tax rate is 0.94%.

Source: pavlabevelina.pages.dev

Source: pavlabevelina.pages.dev

How Much Is Inheritance Tax 2024 Usa Lenka Nicolea, If you leave behind more than $2.193 million when you die, your estate might owe washington state estate tax. Washington’s property tax rate is 0.94%.

Source: www.urban.org

Source: www.urban.org

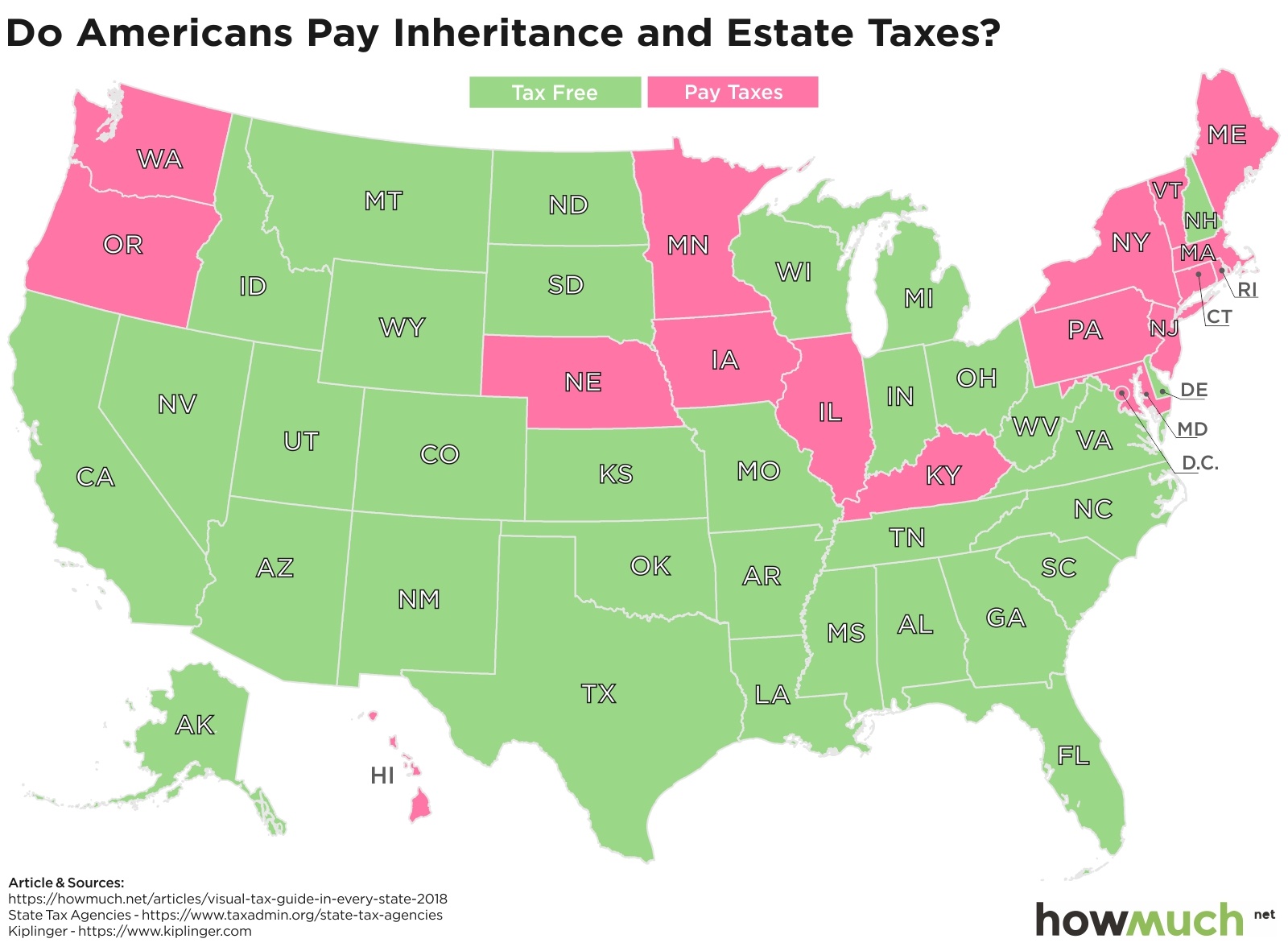

Estate and Inheritance Taxes Urban Institute, In the 2024 primary election, there are 654 total races in washington, including 123 state legislature races, 92 local races, 10 u.s. City, county and municipal rates vary.

Source: www.youtube.com

Source: www.youtube.com

What is inheritance tax like in Washington State? YouTube, For 2024, residents don’t have to file a state estate tax return if the value of their estate is less than the tax exempt amount of $2,193,000, according to washington inheritance laws. Federal and washington estate taxes for 2024.

Source: taxfoundation.org

Source: taxfoundation.org

Does Your State Have an Estate or Inheritance Tax? Tax Foundation, This means that beneficiaries do not have to pay taxes on the amounts they inherit from an estate. If you leave behind more than $2.193 million when you die, your estate might owe washington state estate tax.

The 2024 Washington State Estate Tax Exemption Is Currently $2,193,000 Per Person, The Same Rate As 2023.

Washington’s property tax rate is 0.94%.

The Threshold For The Estate Tax In Washington Is $2.193 Million As Of 2024.

Washington levies an estate tax of 10% to 20%.

Posted in 2024